If you are a self-directed trader looking for cost savings then Schwab is a better option with discount online banking and no commission online trading.Īdditionally, one has the option to open a no-fee Robo-advisor Schwab Intelligent Portfolio account.

You may also like to read – Best stock analysis apps in 2021 Charles Schwab ReviewĬharles Schwab is a Fortune Top 50 world’s most admired company with $6.69 trillion global clients assets under management.

#Streetsmart edge cost full#

If you still need more information to make up your mind then you can deep dive into the full review and detailed side-by-side comparison. Phone calls Chat Visit 300 local branches Yes, Minimums required $5,000 Fee- Schwab Intelligent Portfolios Premium – One-time fee of $300 and $30/ month. Yes Fee up to 0.30% depending on the portfolio value

#Streetsmart edge cost software#

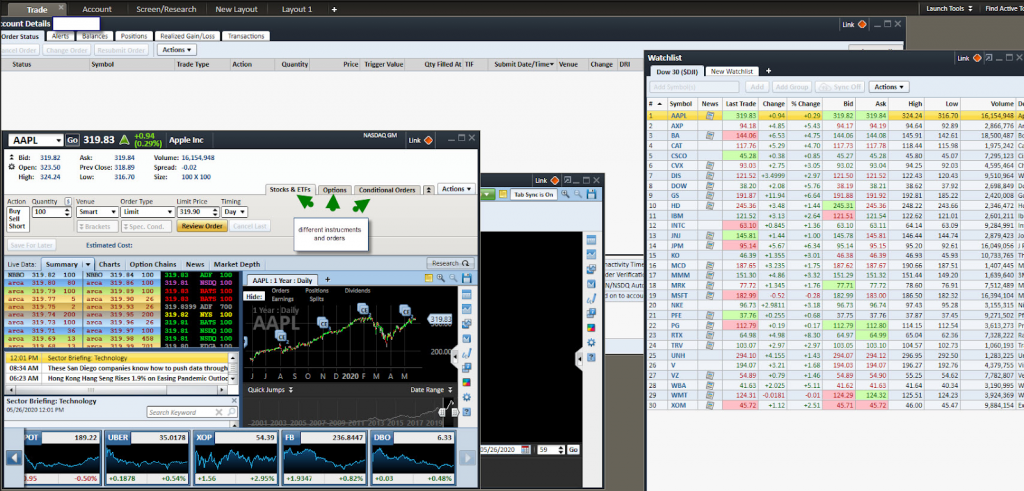

StreetSmart Edge desktop software trading Mobile trading Web-based trading Transaction-fee (TF) mutual funds/ other mutual funds

Stocks & Mutual funds, ETFs, Options, Futures, Bonds, CDs, Money market fund, and Global Investingīoth taxable and traditional IRA and Roth IRA, trust and 529 investment accountīoth taxable and traditional Broking, IRAs, global trading, trust, estate, educational, organization accounts Stocks, ETFs, mutual funds, bonds, options, CDs, mortgage-backed securities, and UITs In case if you are in a hurry, the below is the brief side by side comparison of Vanguard vs Charles Schwab Brief Comparison Schwab vs Vanguard Particulars If you find yourself stuck in picking one of them then the article will help you compare both the brokerages side by side. Whereas, Schwab’s multiple trading platforms, full banking capabilities and plenty of tools seem to support active, self-directed and advisory-based investment style. Vanguard is geared towards long-term strategies & plans suited for passive investment style. However, Charles Schwab is also a bank and when you look closer you will find that there is a significant difference in investment approach. You get in-house research and several advisory services. Charles Schwab and Vanguard, both are full-service brokers offering discount brokerages and a wide range of similar investment products.įor example, Schwan and Vanguard both have a long list of their own and external mutual funds.

0 kommentar(er)

0 kommentar(er)